Option is a financial derivative that represents a contract sold by one party (option writer) to another party (option holder). The contract offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security or other financial asset at an agreed-upon price (the strike price) during a certain period of time or on a specific date (exercise date).

Call options give the option to buy at certain price, so the buyer would want the stock to go up.

Put options give the option to sell at a certain price, so the buyer would want the stock to go down.

European option may be exercised only at the expiration date of the option, i.e. at a single pre-defined point in time

American option on the other hand may be exercised at any time before the expiration date

Strike price – the asset price at which the investor can exercise an option

Spot price – the price of the asset at the time of the trade

Forward price – the price of the asset for delivery at a future time

Notional – the amount of each currency that the option allows the investor to sell or buy

A foreign-exchange option or FX option is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date.

For example a USDINR contract could give the owner the right to sell INR 6,000,000 and buy USD 100,000 on December 31. In this case the pre-agreed exchange rate, or strike price, is 60 INR per USD (or USD/INR 60 as it is typically quoted) and the notional amounts (notionals) are INR 6,000,000 and USD 100,000.

Valuation of a Forex Option: the Garman–Kohlhagen model

Suppose that

is the risk-free interest rate to expiry of the domestic currency and

is the risk-free interest rate to expiry of the domestic currency and  is the foreign currency risk-free interest rate (where domestic currency is the

currency in which we obtain the value of the option; the formula also requires

that FX rates – both strike and current spot be quoted in terms of "units

of domestic currency per unit of foreign currency"). The results are also

in the same units and to be meaningful need to be converted into one of the

currencies.

is the foreign currency risk-free interest rate (where domestic currency is the

currency in which we obtain the value of the option; the formula also requires

that FX rates – both strike and current spot be quoted in terms of "units

of domestic currency per unit of foreign currency"). The results are also

in the same units and to be meaningful need to be converted into one of the

currencies.

Then the domestic currency value of

a call option into the foreign

currency is

The value of a put option has value

where :

is the current spot rate

is the current spot rate is the strike price

is the strike price is the cumulative normal distribution function

is the cumulative normal distribution function is domestic risk free simple interest rate

is domestic risk free simple interest rate is foreign risk free simple interest rate

is foreign risk free simple interest rate is the time to maturity (calculated according to the appropriate day count convention)

is the time to maturity (calculated according to the appropriate day count convention)- and

is the volatility of the FX rate.

is the volatility of the FX rate.

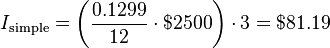

The amount of simple interest is calculated according to the following formula:

where r is the period interest

rate (I/m), B0 the initial balance and mt

the number of time periods elapsed.

To calculate the period interest

rate r, one divides the interest rate I by the number of periods mt.

For example, imagine that a credit

card holder has an outstanding balance of USD2500 and that the simple interest rate

is 12.99% per annum. The interest added at the end of 3 months would be,